PNB Adjusts Lending Rates: The New MCLR and Its Impact on Your EMIs | MSME News

Table of Contents

New Delhi – Punjab National Bank (PNB), a cornerstone of India’s banking sector, has revised its Marginal Cost of Funds Based Lending Rate (MCLR). These new rates, effective from June 1, 2024, are crucial news for countless individuals and businesses, particularly MSMEs, as they directly influence the cost of borrowing. This article breaks down what this financial news means for you.

What Exactly is MCLR?

Think of MCLR as the minimum interest rate a bank can charge for a specific loan. It’s a benchmark rate that is determined internally by the bank based on its own costs—like the interest it pays to you for deposits and its operational expenses. The Reserve Bank of India (RBI) introduced it to ensure that banks pass on the benefits of lower interest rates to their customers more quickly.

PNB’s New MCLR Rates (Effective June 1, 2024)

For anyone with a loan linked to MCLR, these are the numbers that matter. PNB has updated its rates across different “tenors” or time periods. The one-year MCLR is especially important as most consumer loans, like home and car loans, are tied to it.

Here is a clear breakdown of the revised rates in a table for easy understanding:

| Loan Tenor | New MCLR Rate |

|---|---|

| Overnight | 8.30% |

| One Month | 8.40% |

| Three Months | 8.50% |

| Six Months | 8.70% |

| One Year | 8.80% |

| Three Years | 9.10% |

The Impact on MSME News: Why This Matters for Small Businesses

This update is significant msme news. For Micro, Small, and Medium Enterprises (MSMEs), access to affordable credit is the lifeblood of their operations. A change in MCLR by a major lender like PNB has a direct impact on:

- Working Capital Loans: The interest on short-term loans used for daily operations can change, affecting profitability.

- Business Expansion: The cost of long-term loans for buying new machinery or expanding premises will be influenced by these rates.

- Financial Planning: Stable and predictable interest rates are key for MSMEs to plan their finances effectively.

Any scheme for MSME often involves bank financing, so tracking these base rates is essential. This news helps business owners make informed decisions about future borrowings. For more information on government and bank schemes for MSME, entrepreneurs often visit portals like Udyam and others.

How Will This Affect Your Personal Loan EMI? A Use Case

If you have a loan that is linked to the MCLR, your EMI will not change immediately. Instead, it will be revised on the “reset date” mentioned in your loan agreement. This is usually after six months or one year.

Example:

- Let’s say you have a home loan of ₹30 lakhs for 20 years, linked to the 1-Year MCLR.

- Your previous interest rate was based on the old 1-Year MCLR (e.g., 8.75%) plus a “spread” or margin (e.g., 0.50%), making your total rate 9.25%.

- When your loan’s reset date arrives, the new 1-Year MCLR of 8.80% will be used. Your new rate will be 8.80% + 0.50% = 9.30%.

- This slight increase will result in a small rise in your monthly EMI.

Important Note: Borrowers whose loans are linked to an external benchmark, like the RBI’s repo rate (often called RLLR or EBLR), will not be affected by this MCLR revision.

Frequently Asked Questions (FAQ)

What is the main difference between MCLR and EBLR/RLLR?

MCLR is an internal benchmark set by the bank based on its own costs. EBLR (External Benchmark Lending Rate) or RLLR (Repo-Linked Lending Rate) is linked to an external benchmark, most commonly the RBI’s repo rate, making it more transparent and faster to transmit rate changes.

How do I know if my loan is linked to MCLR?

You can find this information in your loan agreement document. If you are unsure, you can contact your PNB branch or check your online banking portal.

3. Will this PNB news affect my application for a new loan?

Yes. If you apply for a new loan that the bank offers on an MCLR basis, the interest rate will be calculated using these new benchmark rates.

Why is this considered important financial and msme news?

It signals the bank’s assessment of the current cost of money and the economic environment. For MSMEs, it’s a key indicator for borrowing costs, which is a major factor in business planning and growth.

Where can I find more information on schemes for MSME?

Besides the bank’s official website, government portals like MSME Champions and dedicated financial news websites are good resources to stay updated on the latest schemes.

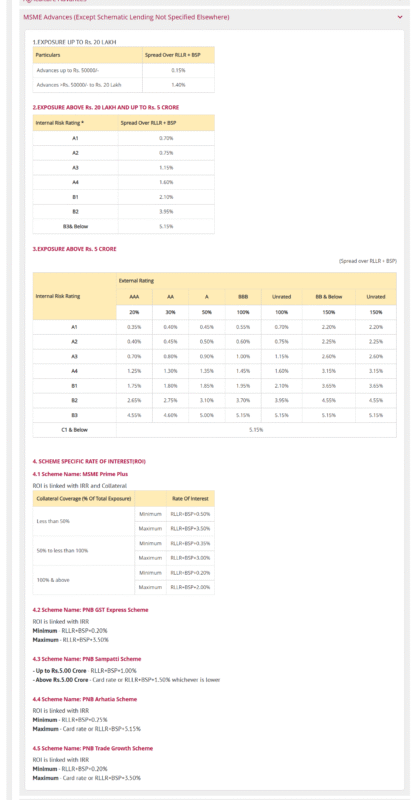

News Source : MSME Advances (Except Schematic Lending not Specified Elsewhere)